ABcann: Going Public with Standardized Pharma-Grade Cannabis

Ryan Allway

April 12th, 2017

News, Top News

ABcann: Going Public with Standardized Pharma-Grade Cannabis

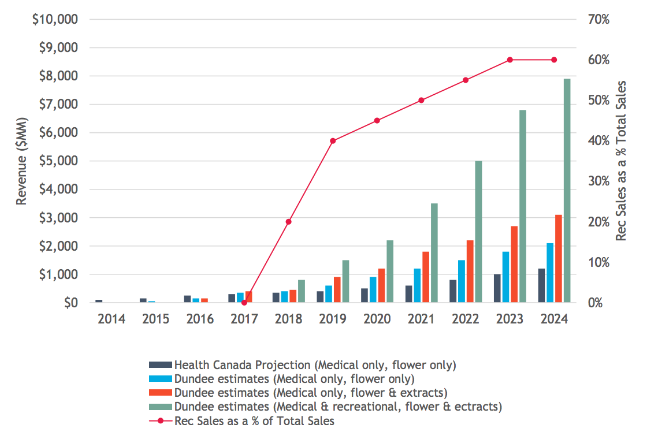

Canada’s cannabis industry is expected to grow from $240 million to upwards of $4 billion by 2019, which analysts believe will create a dramatic shortfall in supply. With around 40 licensed producers, investors have a unique opportunity to invest in an oligopoly that has already minted at least one cannabis ‘unicorn’ with a market capitalization of more than C$1 billion. The next big opportunities may be already-licensed producers that have yet to go public.

In this article, we will take a look at ABcann Medicinals Inc.’s scientific approach to the cannabis industry and why investors may want to take a closer look ahead of its going-public transaction.

Click Here: Sign-up for Investor Presentation and E-Mail Alert for Pending IPO

Rapidly Growing Market

Canada’s cannabis industry is expected to grow from about $240 million in 2016 to upwards of $4.6 billion by 2019, according to PI Financial, which believes that the industry will experience a nearly 200,000 kilogram shortfall in supply by that time. Based on its projections, the analyst believes that Canadian licensed producers will need to cultivate a total of 610,000 kilograms of cannabis to fulfill domestic and export demand by 2019.

“The rigorous process of becoming a licensed producer of cannabis in Canada imposes significant barriers to entry and there will be a shortfall in supply in a legalized market in the short-term until production capacities catch up by 2020,” said Canaccord Genuity Group Inc. analysts in a November 2016 research note. This could create an enormous opportunity for existing licensed producers that enjoy an oligopoly over the short- to medium-term.

In terms of revenue, the market for cannabis is expected to rival the size of the beer, wine, and spirits industries as the number of marijuana users is expected to steadily rise to nearly four million during the first full year of recreational legalization. Canada could also become a leading exporter of cannabis given its growing experience in the industry, which could significantly increase the size of the market over the long-term as liberalization continues around the world.

Efficient, Pharma-Grade Approach

ABcann Medicinals is well-positioned to capitalize on the opportunity as a globally-licensed, cost-efficient producer of premium quality organic standardized medicinal cannabis. The company’s core advantage is its advanced growing technology that is capable of creating a consistent, organically-grown, pesticide free, and standardized product where every variable in the growing process is optimized and computer-controlled for the best results.

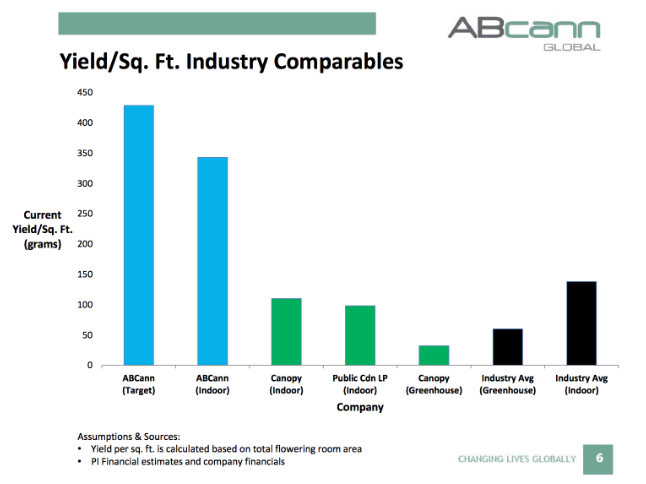

The company has conducted extensive research and development in conjunction with the University of Guelph’s Controlled Environmental System Research Facility. Through a 3-year partnership, the company invested $1.5 million in research at its Vanluven facility in Napanee where researchers were able to produce yields more than 100% over the industry average – providing both a cost and quality advantage over competitors.

“After visiting ABcann’s production facility in Canada, I personally witnessed that their production technologies put them in a class with the best in the world in their ability to produce standardized pharmaceutical grade cannabis,” said Syqe Medical Founder Perry Davidson, whose company recently signed a deal with Teva Pharmaceutical Industries Ltd. (NASDAQ: TEVA) to distribute its medical cannabis inhaler and has become an ABcann customer.

The company has leveraged its technology to produce a variety of strains and compound combinations for the best therapeutic results from high THC, to balanced, to high CBD. This variety gives healthcare providers the best options for recommending the appropriate prescriptions to treat conditions ranging from arthritis to schizophrenia with the confidence that each dosage of the product will be the same high quality medicine.

The standardized products could also provide a basis for clinical trials.

“I believe that the route followed by ABcann for standardized cannabis grown under strict conditions, leading to reproducible contents, will not only satisfy physicians but will also make possible clinical trials which will develop the evidence to transform how cannabis is perceived today in the pharmaceutical industry and the regulatory agencies,” says Professor Raphael Mechoulam of the University of Jerusalem. Mechoulam is a widely known cannabis scientist whose team first isolated THC and identified the endocannabinoid system in the human body. He also sits on ABcann’s Medical Advisory Board.

Looking Ahead

ABcann Medicinals has an existing 14,500 square foot facility in Napanee, Ontario with a production capacity of 1,000 kilograms per year. During the first half of this year, the company plans to add an additional bloom chamber to help increase capacity in the near-term. The Phase II Kimmett Facility consists of a 71,500 square foot facility with a production capacity of 20,000 kilograms per year and construction is already underway.

Beyond these facilities, the company owns 65 acres of property that’s ready for development with power, water, and waste infrastructure in place. Management believes that this land is sufficient to support an estimated 1.2 million square feet of production space that could be used to produce a significant amount of cannabis each year. The Phase II buildout would put the company ahead of many existing licensed producers that have achieved high valuations.

Investors may want to keep a close eye on ABcann Medicinals Inc. as it moves closer toward a public offering. For more information, sign-up to receive the company’s investor presentation and e-mail alerts for its public offering date.

This article was published by CFN Enterprises Inc. (OTCQB: CNFN), owner and operator of CFN Media, the industry’s leading agency and digital financial media network dedicated to the burgeoning CBD and legal cannabis industries. Call +1 (833) 420-CNFN for more information.

Network Partners

About CFN Media Group

CFN Enterprises Inc. (OTCQB: CNFN) owns and operates CFN Media Group, the premier agency and financial media network reaching executives, entrepreneurs and consumers worldwide. Through its proprietary content creation, video library, and distribution via www.CannabisFN.com, CFN has built an extensive database of cannabis interest, assisting many of the world’s largest cannabis firms and CBD brands to build awareness and thrive. For more information, please visit www.cfnenterprisesinc.com.

Disclaimer: Matters discussed on this website contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. CFN Media Group, which owns CannabisFN, is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. CFN Media Group, which owns CannabisFN, may from time-to-time have a position in the securities mentioned herein and will increase or decrease such positions without notice. The Information contains forward-looking statements, i.e. statements or discussions that constitute predictions, expectations, beliefs, plans, estimates, or projections as indicated by such words as "expects", "will", "anticipates", and "estimates"; therefore, you should proceed with extreme caution in relying upon such statements and conduct a full investigation of the Information and the Profiled Issuer as well as any such forward-looking statements. Any forward looking statements we make in the Information are limited to the time period in which they are made, and we do not undertake to update forward looking statements that may change at any time; The Information is presented only as a brief "snapshot" of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities and to consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.pinksheets.com, www.otcmarkets.com or other electronic sources, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the Pink Sheets or www.otcmarkets.com; (c) obtaining and reviewing publicly available information contained in commonlyknown search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.com. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and OTCMarkets and/or have negative signs at www.otcmarkets.com (See section below titled "Risks Related to the Profiled Issuers, which provides additional information pertaining thereto). For making specific investment decisions, readers should seek their own advice and that of their own professional advisers. CFN Media Group, which owns CannabisFN, may be compensated for its Services in the form of cash-based and/or equity-based compensation in the companies it writes about, or a combination of the two. For full disclosure, please visit: https://www.cannabisfn.com/legal-disclaimer/. A short time after we acquire the securities of the foregoing company, we may publish the (favorable) information about the issuer referenced above advising others, including you, to purchase; and while doing so, we may sell the securities we acquired. In addition, a third-party shareholder compensating us may sell his or her shares of the issuer while we are publishing favorable information about the issuer. Except for the historical information presented herein, matters discussed in this article contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. CFN Media Group, which owns CannabisFN, is not registered with any financial or securities regulatory authority, and does not provide nor claims to provide investment advice or recommendations to readers of this release. CFN Media Group, which owns CannabisFN, may from time to time have a position in the securities mentioned herein and will increase or decrease such positions without notice. For making specific investment decisions, readers should seek their own advice and that of their own professional advisers. CFN Media Group, which owns CannabisFN, may be compensated for its Services in the form of cash-based and/or equity- based compensation in the companies it writes about, or a combination of the two. For full disclosure please visit: https://www.cannabisfn.com/legal-disclaimer/.

Copyright © Accelerize Inc. · All Rights Reserved · Privacy Policy · Legal Disclaimer